Becoming a genuine financial planner is good for you and good for your business.

If you already consider yourself a financial planner, you know this.

If you’re flirting with the idea of moving your business into the financial planning space then let me explain why my opening statement is true.

What’s in it for you?

Let’s start with the good stuff.

Running a financial planning business model means:

- Greater financial rewards

- More consistent financial rewards

- Personal and professional fulfilment

- Personal growth

- Your interests 100% aligned with the client

I know there are some old-school advisers who generate ridiculous amounts of new business, doing it the old way. However, it’s getting harder and harder to do that. They might get away with it for a few more years, but then they might find themselves out of business, so I’m not counting that as winning on the financial front.

It’s like saying that someone who made a 300% return last year on Bitcoin is a great investor.

You can run a financial planning model and make great money. The two ideas are not mutually exclusive. Additionally, the recurring revenue portion of your income creates much greater financial stability and a hugely increased final sale value for your business.

Financial planners look at what the client’s money is for. When you focus on that as your outcome, your interests become 100% aligned with the client.

When you become a financial planner you no longer sell people:

- Investment returns

- Tax savings

- Insurance products

- Mortgages

- Pensions

These things become tools that you sometimes use to fix the real issues clients face, like:

- How much is enough?

- Will my money last as long as I do?

- How do I live my best life with the financial resources I have at my disposal?

As an adviser, this is a much more exciting, fulfilling and profitable way to go through life.

What to work on

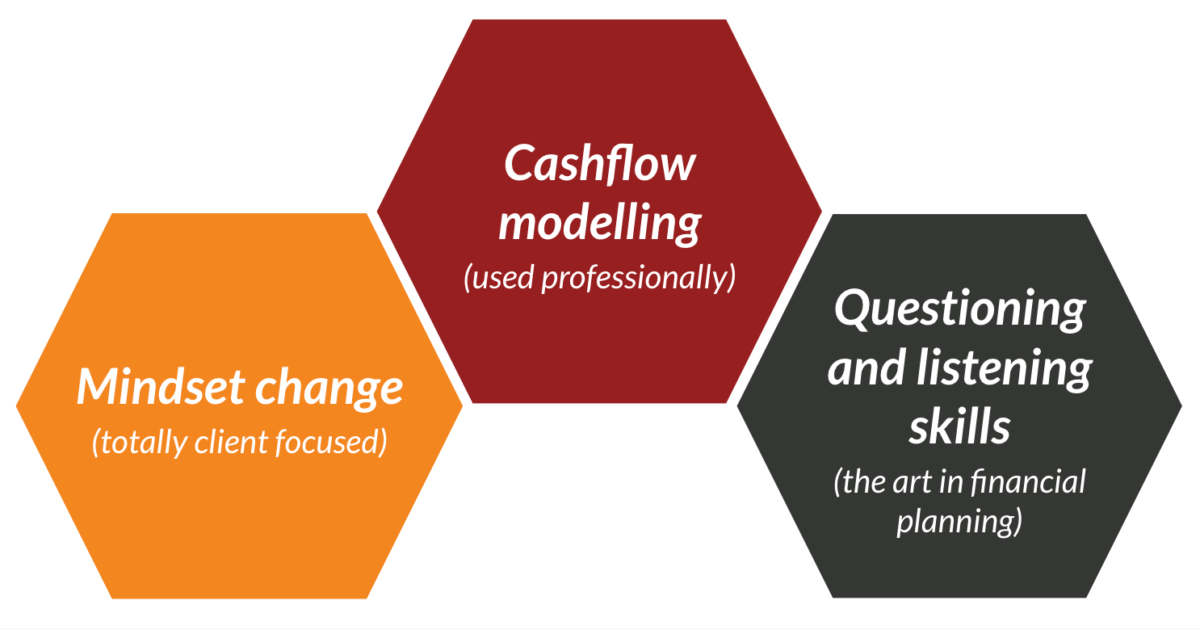

If you want to move yourself and your business into a financial planning model I believe there are three main things to focus on:

- Mindset

- Cashflow modelling

- Questioning and listening skills

Most advisers I know genuinely care about trying to do the right thing for their clients. Yet the way we were taught to sell, advise, solve problems (whatever you want to call it) in the past, was well-suited to selling products, but not well-suited to helping clients identify the real issues they face.

So the first step is to get a totally client-focused mindset. That means doing whatever is in the best interests of the client in front of you, regardless of whether that leads to a ‘sale’ of something or not.

The second step is to get cashflow modelling at the heart of your business and use it with every client.

Some advisers are resistant to cashflow modelling and wonder why they need it.

All I can tell you is to speak to advisers who now use it. They’ll tell you that their client relationships were great before they introduced cashflow modelling as part of their approach, but now they’re relationships are 3x better than before. It’s that powerful.

Why?

I think the bottom line is that it allows the client to see and understand their financial situation for the first time. They don’t just have to take your word for it that “everything’s going to be alright.”

And if you’re worried about the spurious accuracy of a cashflow model (as you should be), just know that you’ll never be building a forecast for the next 30 years and leaving the client to it.

Your doctor doesn’t take a blood test or an X-ray and base the next 30 years of medical advice on a single test. You won’t be basing your financial advice off a single cashflow model either. You’ll be working with the client year after year and updating your model to keep everything on track.

The third step is to double down on your questioning and listening skills. You already know this is the holy grail of great selling and communication skills. Great financial planners have taken their questioning and listening skills to a whole new level. It’s the art in the job.

The good news?

All three of these skills can be learned. There’s no barrier to acquiring them.

Why bother?

Speak to some financial planners. Making the transition from a financial adviser to a financial planner is something special.

It might take a little bit of work to get your head around it, but then it’s like a new lease on life. You could do it forever.

If you want to get started I’ve listed some resources for you below.

Let me know how you go.

Some Resources For You

I did a webinar for the PFS Power website called Why Financial Planning Is Good For Your Business. It provides a more in-depth explanation of the power of financial planning for you and your business.

You can find it here.

If you want some step by step guidance on building a financial planning business then check out my membership community, Uncover Your Business Potential Online. It’s like having “Brett in your pocket”. I can give you specific advice on a daily basis using the UYBP-Online App (available on Apple or Android).

I also provide live training on Zoom a few times a month and there are over 65+ self-study videos about all aspects of running a financial planning business.

For improving your questioning and listening skills check out:

For cashflow modelling skills: The Voyantist

For a wide range of educational qualifications and free resources:

- The Personal Finance Society – PFS Power

- The Chartered Institute for Securities and Investment

Making the transition from a financial adviser to a financial planner is something special.

A wise person once told me, “If you find an amazing blog that gives you loads of free help and advice, sign up to it straight away, so you get it before everyone else.” Ok, I’m making that bit up, but I’m sure there’s someone would give me that advice. If you think it makes sense then sign up to my weekly blog below. (You can leave anytime, although I don’t think you’ll want to)

2 comments to " Want To Become A Financial Planner? (here’s how you do it) "