The conversation I have most often with owner-advisers is about “What next?”

That is, how do they ensure that their business legacy and their clients are not damaged by a buyer who doesn’t really share their values?

Most Financial Planning firms I know are not a good fit with the consolidator offerings out in the marketplace. As the founding owners approach the latter stages of their careers, the thorny issue of ‘What next? looms large.

A few years ago I attended a fantastic session in the US with Roy Ballentine (the founder) and Drew McMorrow (his chosen successor) from Ballentine Partners, on how they dealt with the succession issue. Ballentine Partners might just be one of my shortlisted candidates for best Financial Planning firm in the US, so I was listening hard.

Here are a few top tips and questions arising from that session.

❓The Key Question

Roy opened with the following statement:

“One way or another you’ll have to answer the question, ‘Who will lead my firm when I am no longer able to do so?’”

There are four options you can pursue:

- Promote someone from within – internal succession

- Hire from outside – external succession

- Sell your firm – a form of external succession

- Liquidate your firm – not really an option, so let’s exclude it

Clearly, it’s best to get started on this nice and early, because if you have any failures this could be a three, five or ten-year process.

🚧 Separate Ownership from Governance

The succession planning problem becomes easier to solve if you separate ownership from governance/management of the firm.

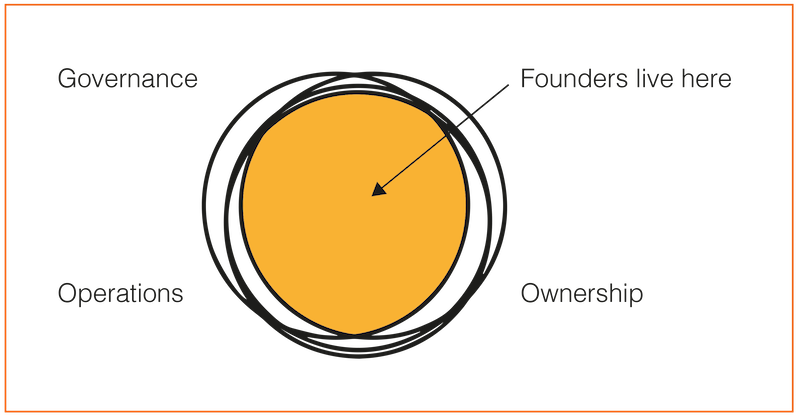

For owner/founders their responsibilities look like this:

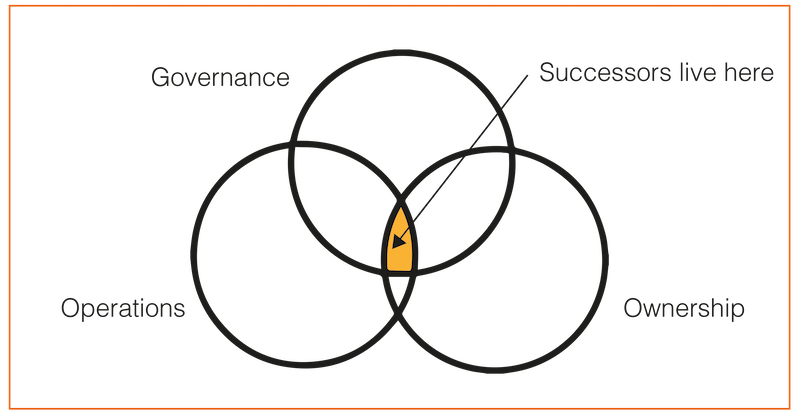

However, for the successor, it looks like this:

Source: Ballentine Partners

As the original owner/s grew the firm from scratch, they often did it all. The successor won’t do that.

Because the firm is larger, different leaders in the firm will take on some of those roles and report to the successor.

Most firms I interact with that are pursuing succession have attained a level of turnover where they’ve hired an Operations Manager or Practice Manager. So there’s already the beginnings of a leadership group.

👓 What are you seeking in a successor?

It’s important to think about the traits you are seeking in a successor.

Roy outlined the five traits he was seeking:

- Investment professional

- Ambassador/Super salesperson

- Charismatic leader

- Manager

- Wealth planning professional

However, you may not be able to find someone who can do all of those things. In fact, it’s likely that you won’t. You need to evaluate whether you can compensate in other ways for any shortcomings, or indeed whether your successor/s can do the job. There will be trade-offs and compromises to be made. Generally speaking, no one is all of these things.

If your successor can do two or three of these things very well, it’s certainly possible to lean on others or to hire-in the skills necessary to compensate for the rest.

For example, a lot of successors are not the natural rainmakers that the original owners were. This need not be a sticking point. In a mature firm, the business’s marketing has already assumed a life of its own to some extent or can be turned into a business process. It doesn’t have to rely on the skills of one single rainmaker as it might have done in the past.

🎯 What are your succession goals?

It’s important to have some goals when you consider succession. What are you actually trying to achieve?

Like all things business related, the clearer you can get in the thinking and planning phase, the easier decision making gets in the execution phase.

Without that clarity, everything looks like an interesting option. However, that’s a road to confusion for you and your business and will slow up the succession process.

Here is a list of the succession planning goals for Ballentine Partners:

- To answer the question, “Who will lead the firm when our founder retires (or dies)?”

- To remain independent

- That the employee group retain majority ownership and control

- To retain all senior team members, if possible

- To empower and motivate the next generation of leaders

- To position our firm for the next phase of growth

- To identify leadership that will reaffirm the firm’s values

The goals you set for your own succession will drive your decision making. You might come up with a list of goals that are materially different to the ones above, and as a result, take a different approach. That’s totally cool.

However, you need to do the ‘think work’ before taking action.

The succession planning process

here are some key questions that you will need to answer about the process:

- Is the founder really ready to make room for new leaders?

- Who will make key decisions?

- Should you hire a consultant? If so, what type?

- Will it be a competitive or collaborative selection process among key employees?

- How do we prevent the process from creating winners… and those who feel they lost?

- Who will be involved?

- Will you interview both internal and external candidates?

- Will the process be secret or open?

- What are the criteria by which candidates will be evaluated?

- How do we retain everyone in the firm we wish to retain?

- How do we ensure we retain our clients?

The risk of failure

What if you do all of this and your first choice successor doesn’t work out? It happens.

You need to address the risk of failure.

- How much collateral damage will your firm suffer if this goes wrong?

- How will the founder respond to failure?

- Give up?

- Try again?

- Change course?

- What lessons can be learned from failure?

This is not something to be feared, but something to be planned for.

You’ve done this your whole life as a business owner; hoping for the best while planning for the worst. It’s the environment you’ve always operated in. Succession planning is no different.

Remember the goal:

To ensure that your business legacy and your clients are not damaged by a buyer who doesn’t really share your values.

✅ Successful succession

Succession planning is one of the biggest issues you’ll face as a business owner. It can be exciting and terrifying all at the same time.

However, if you are prepared to knuckle down and do the planning work, you can finish your career the way you’d always hoped you would, and leave a legacy to be proud of.

Uncover Your Business Potential

A crystal clear coaching programme for adviser-owners who want to create a world-class financial planning business.

If you think it’s time to take that next bold step, then let’s set up a call.

Have you loved this week’s blog? Really? Then do yourself a favour and sign up to receive it weekly. You’ll get it before anyone else and you can wave goodbye at any time (although I don’t think you’ll want to)

1 comment to " How To Create Your Own Succession Plan "